A Comprehensive Guide to the Kentucky Tax Registration Application Form

Understanding Kentucky tax registration

Kentucky tax registration is an essential process for both individuals and businesses operating within the state. This registration ensures compliance with state tax laws and allows entities to fulfill their tax obligations accurately. It serves as an official record of your intent to engage in taxable activities, whether that be through employment, business operations, or sales.

For businesses, tax registration is particularly crucial as it establishes their legal standing and tax compliance status with the Kentucky Department of Revenue. Individuals also need to register, especially when they anticipate income that requires tax reporting, such as freelancers and independent contractors.

Legitimizing your business

Facilitating state aid and loan opportunities

Who needs to register for taxes in Kentucky?

In Kentucky, both individuals and businesses may need to register for taxes, but the requirements differ based on the nature of the entity. Individuals must register if they earn income subject to tax or if they are self-employed. Businesses, on the other hand, are legally required to register upon formation in Kentucky.

Sole proprietorships, limited liability companies (LLCs), and corporations all have specific registration needs. For instance, sole proprietors might register under their name, while LLCs will need to provide formation documents. New corporations must complete filings that reflect their structure and tax obligations.

Sole Proprietorships: Register as an individual.

LLCs: Business formation documents are required.

Corporations: Must follow specific state filing requirements.

Preparing for your Kentucky tax registration application

Before diving into the Kentucky tax registration application form, it’s essential to prepare the requisite documents. Having these documents ready will streamline the registration process and reduce potential delays.

Crucial documents include your Social Security Number (SSN) or Employer Identification Number (EIN) for businesses, as these serve as your tax identification. Additionally, business formation documents—such as Articles of Incorporation or Operating Agreements—are vital for establishing your business structure. Owner identification, which may include a driver's license or government-issued ID, is also necessary to verify the applicant’s identity.

Social Security Number or Employer Identification Number (EIN)

Business formation documents (e.g., Articles of Incorporation)

Owner identification (e.g., driver’s license)

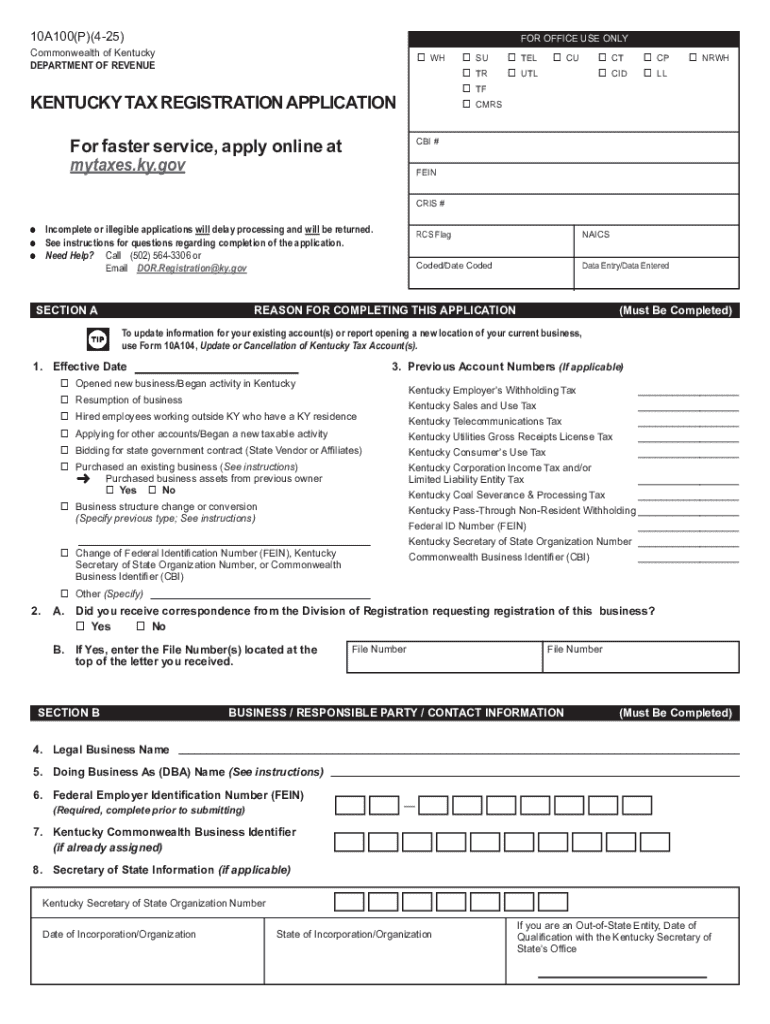

Step-by-step guide to completing the Kentucky tax registration application form

Step 1: Accessing the registration form

To start the registration process, locate the Kentucky tax registration application form on the Kentucky Department of Revenue website. You can choose to download the form for paper submission or complete it online, depending on your preference and convenience.

Step 2: Filling out the application

While filling out the application, each section requires specific information. The Personal Information section will capture your details, including name, address, and contact information. The Business Information section will cover your business structure and activities. Finally, the Tax Type Overview section specifies what taxes you will be liable for, such as sales tax or corporate income tax.

Avoid common mistakes during this phase, such as typos or leaving mandatory fields blank, as these can delay processing.

Step 3: Submitting your application

Once the form is completed, you can submit it through various channels. The online system allows for immediate submission, while you can also send it via mail or deliver it in-person at designated offices. Be aware that certain fees may apply, depending on the nature of your application.

Processing times vary, but after submission, you can expect updates on your application's progress, which significantly helps in managing your business timelines.

After registration: What comes next?

Following successful registration, it’s crucial to confirm your registration status. You can verify this directly on the Kentucky Department of Revenue's website. Upon confirming, you will gain access to an online account that allows you to manage your tax obligations, view payment schedules, and stay updated on any changes in the tax landscape.

This account becomes your hub for ensuring compliance, making payments, and tracking due dates, which is vital for maintaining good standing with the state. Regularly checking this account will prevent any lapses in tax payments and avoid potential penalties.

Managing changes to your registration

Changes in your business structure or operations necessitate updates to your tax registration details. If your business name or address shifts, or you switch your organizational structure (like moving from a sole proprietorship to an LLC), it's crucial to inform the Kentucky Department of Revenue, ensuring records are accurate.

Reinstating registration after cancellation is also a possibility for businesses that have ceased operations temporarily. In certain situations, amendments to your application may be necessary, especially if errors were made in the original submission. The process for amendments is generally outlined on the Department of Revenue’s website.

Frequently asked questions about Kentucky tax registration

One common inquiry regarding the Kentucky tax registration application form pertains to mistakes made on the form. If you notice an error post-submission, contact the Kentucky Department of Revenue immediately to seek guidance on corrective measures. Prompt action is key in such situations.

Another frequent question involves tracking one's application status. Applicants can easily check their registration status through an online portal provided by the department. It is advisable to keep all documentation handy in case of verification needs or follow-ups.

Lastly, if you receive a notice from the Kentucky Department of Revenue, follow the instructions carefully. This could involve additional information requests or clarification to ensure compliance and avoid penalties.

Additional resources for tax registration in Kentucky

When tackling the Kentucky tax registration application form, various resources are at your disposal. Direct links to the Kentucky Department of Revenue’s website provide access to the latest forms, instructions, and updates on tax requirements. Familiarize yourself with the contact information for tax assistance services, as well as legal resources available within Kentucky that cater to small businesses and individual taxpayers.

Additionally, utilizing interactive tools can significantly ease the burden of document management and tax compliance, especially for those who manage multiple forms or transactions.

Collaborative document solutions with pdfFiller

pdfFiller presents a valuable solution for those navigating the intricacies of the Kentucky tax registration application form. With features tailored for seamless document creation and editing, users can fill out, eSign, and manage their forms all from a cloud-based platform.

The interactive capabilities of pdfFiller offer advantages such as saving progress and collaborating with team members, making it a practical choice for individuals and businesses alike. The ease of use and adaptability of pdfFiller help streamline the tax registration process, ensuring that your tax documents are not only accurate but also compliant with state regulations.